SAPA.

A term used in Nigerian Pidgin English to describe a state of being extremely broke or poor, usually after spending extravagantly.

The final stage of brokenness is where all hope is lost.

A term to describe a state of being financially finished, without funds, naira less, bankrupt.

Serious absence of purchasing ability.

I laughed at the terms used to describe the word I just googled- SAPA.

I looked back at my years, I think between ages 20-36, and I realised I was a walking example, I was always broke. And I mean always, money never stayed in my pocket and it took years for me to realise why.

Looking back now, I understand it was not just one issue I had, it was a collective issue. Maybe my ‘village people’ join sef.

As a foreigner in Russia, I sure lived beyond my means. My first problem was that I couldn’t say no! Be it a party or a gathering of other communities, as long as it involved enjoyment, you would find me there.

I was always on an enjoyment spree, spending every money that fell into my hands, I was an advocate of living ‘large while you can’.

While keeping up this lifestyle, I didn’t really have a stable source of income, I was paid by my government when I was a scholarship student, and upon completing my four-year course, the money stopped coming but my lifestyle didn’t change.

From doing menial jobs, to receiving money from my siblings, I was still able to live the way I wanted.

I hated topics relating to financial literacy, budgeting, and cutting down on some things. Those topics were boring and infuriated me, made me sad even. I felt money was to be spent and enjoyed, and all these rules were just ways to tie you down.

So I had no budget, no savings, and in fact, no idea of how the next few years of my life were going to turn out. I lived in the moment and that was fine by me.

I also loved gadgets, big ones o, the flashy ones that give me a reputation of being rich even though I lived in a shack. My hopes were that after proper packaging, I will meet the right people, and make the right connections that will take me to the next level. But I was so wrong.

Hmm, soon enough reality kicked in, and about two years post-graduation, I became very ill. I had never taken my health that seriously, so this sickness hit me real hard. I was hospitalised for about two weeks and with no medical insurance.

I had to cover every single bill. Without being capable of working and having no form of savings, I turned to my family members. I can’t really explain why or how but my family members who had been supporting me for a while suddenly became reluctant.

I was over 26 years and in all my years I had never felt so rejected, every single person had an excuse from personal issues to company problems.

Long story short, I was on my own and I thought I was going to die. In fact I am sure I touched heaven but it was like these people did not believe that I was sick and close to death. Now, some of my close pals helped me but it did not go a long way, I needed more money even after my illness.

I had to take a loan, to first clear out my hospital bills and also cater for myself after.

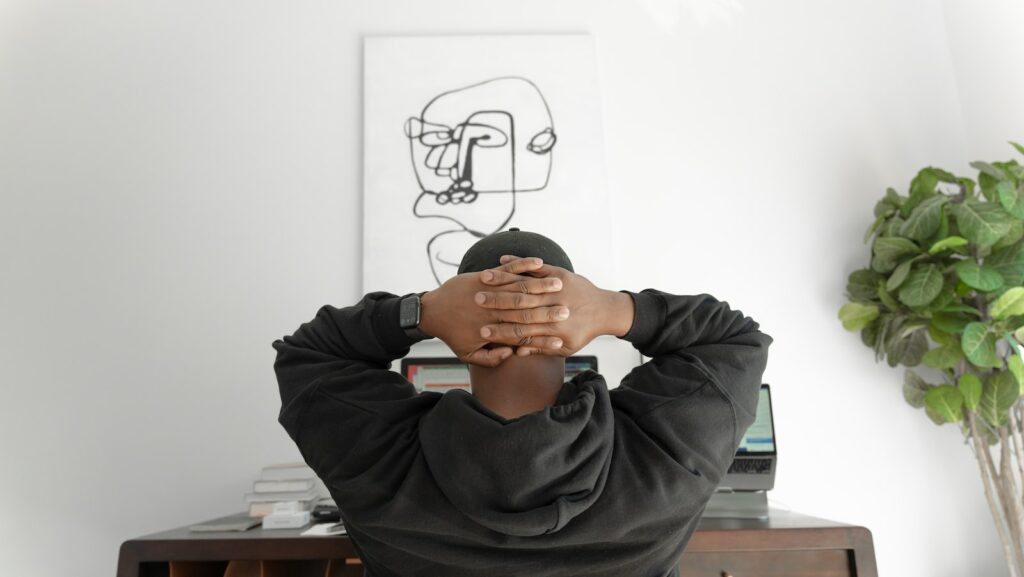

On coming back from the hospital, I sat down and reevaluated my life choices. I was shocked at how low I had fallen financially, it only took an illness for me to realise. I became determined to do better.

I started with job hunting, my certificate from school was satisfactory and by God’s grace, I was able to get an average-paying job. I started menial jobs on weekends and saved the proceeds.

Gradually I got bonuses from work and was able to combine a few things. I was determined to go back for my master’s degree but at that time it was not possible. Penny after penny my savings got better.

I became wiser and stopped attending all the functions I was invited to, and even my trips to supermarkets and big stores were reduced drastically. I became content and started budgeting. I made some successful investments and my life changed gradually.

I was no longer annoyed by financial literacy talks. In fact, I now love to share with people ways they can become financially free.

Looking back, I thank God for that illness and the reaction I received from my family members. It was the propelling force that stopped me on the path to being forever broke.

Being broke especially constantly is never to be taken lightly or toyed with.

Of course there are days when things might not align despite our hard work. Whether intentionally or not, we might find ourselves on the path of SAPA. But it also totally depends on us to find a way out with better financial decisions or to continue treading the path.

Every single individual has the ability to change their situation, you can start with the little things and gradually you will see change.

And that, my friends, is how I left SAPA!